Every day now media publish woeful stories of markets battling over-capacity, of investors fleeing a bear market, of governments desperate for revenue and of miners fighting for survival. Quite different from the expected ongoing bright future of a commodities Super Cycle that few had predicted. In this two-part article Mike Schussler, Director of South Africa’s leading private economic research house Economists.co.za, warns of a likely long-term depressive leg that will result in a massive realignment of the world economy:

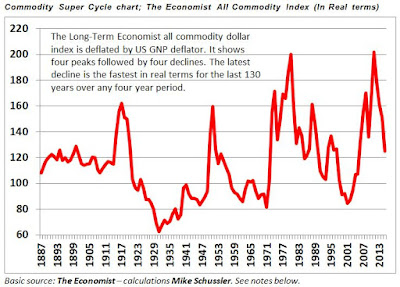

IF YOU BELIEVE THAT history repeats itself then you may feel vindicated by analysing The Economist's Commodity Price Index over the last 130 years. The repeating history theory clearly indicates that global commodity prices are very likely to remain suppressed for another 15 years or so if we follow the last four cycles since 1887.

The cycle currently shows that the world has entered the fastest slowdown in commodity prices since 1931 on a four year basis and currently we are on track for the fastest five year decline since then too.

The result will be a massive realignment of the world economy. The power now goes back to the consumption-based economies. Advanced economies will be big benefiters while commodity and oil producers in Latin America, Africa, the Middle East, Asia and Russia will find economic growth slow.

A short history of the commodity Super Cycle

There are four clear major peaks which are about 30 years apart from each other. This shows that the cycles are about three decades long.

Each cycle has an upward decade and a massive declining five-year period follow by a slower downward decline of 15 years or so. The last part of the cycle is perhaps more flat in nature before the last fall.

The peak years were 1917; 1951; 1980 and 2011. The troughs are 1931; 1971 and 2002. The next trough should be around 2030.

The first peak in 1917 had more to do with the demand for iron and food during the first World War and the end of the first wave of globalisation. The supply of some food stuff was very limited while the world was at war and extraction of minerals was in some cases interrupted. From 1903 to 1917 the index rose 40% in real terms! (This was before central banking so prices did not rise as much as the next three cycles)

The second World War lead to a real price rise of about two-thirds but it was the vast rebuilding of the post-war world that lead to higher commodity prices and the big growth burst in the USA that lead to a peak in commodity prices in the early 1950s This rise was 155% from 1938 to 1951!

This was the longest and strongest rise as Keynesian economics came into play and the war demand for iron ore along with oil (never part of the Commodity Index) and difficulties in getting food to markets.

Additional to the supply and demand changes, the world started walking off the Gold standard and the era of paper and printed money truly arrived. The 1930s was the most difficult period in recent economic history as most countries saw unemployment rocket and some had deflation while others had hyperinflation.

Central Bankers still learn from this era and the recent monetary policy around the developed world has been an attempt to push money into economies. Ben Bernanke, Chairman of the United States of America's Federal Reserve from 2006 to 2014, had studied the great depression and learned that easy money was a large part of the answer but not for ever. As the USA pulls the plug on super easy money that nobody wants any more, the cracks will increasingly show up.

The resumption of global trade and the rise of Europe and Japan followed by the Asian Tigers - along with the oil crisis - lead to commodities (including gold this time) rising for a decade and peaking in 1980. Oil too peaked then at price far higher in 1981 than it is currently! From 1971 to 1980 real prices rose 145%.

Thirty years later, the last peak in 2011 was the result of China and some other rising emerging economies becoming the biggest users. They created a demand that needed to be satisfied but supply took a while to get going again. From 2001 to 2011 real price in dollars rose by 140%. It was quickly called the “Super Cycle”

The upward part of the “Super Cycle” is between 9 and 12 years in most cases and its "discovery" leads many to think it will never finish.

Nobody thought China would end and a whole new world was coming – remember?

China was forever – as was Japan and the Asian Tiger before and Europe’s rebuild before then.

However, the bad news from history is that the price of commodities declines and stays low for about 20 years in every case. The high growth falters just as major new supply of commodities come to the market.

The average real price total decline from peak to trough is 56% in real terms. Over the past four years the Index has declined only 38% in real terms but the real problematic part is that the nominal fall in prices is the fastest over any four year period since 1931!

So it looks like there will probably be further actual declines in the next decades although at a slower pace. The good news is most of the big declines are behind us.

See also Part 2: Consequences of the Super Cycle downturn: changes for commodity nations, companies (12 February 2016)

A note on the data used and methods: For over 150 years The Economist newspaper has published commodity price indices that measure the value of commodities that the world uses. Every week the commodity indices are watched not only by market watchers but inflation watchers and analyst who cover emerging markets as the commodity prices. As an economist with a fair bit of interest in longer business cycles (a hobby of sorts) I have over the decades followed this and other commodity indices. The Economist US dollar commodity index is not perfect but it is the longest running global commodity index and is currently made up of the 25 most traded commodities other than gold and oil which are monitored separately on the same page. The weekly numbers for each year since 1887 are averaged for each year giving an annual view of the world commodity prices and by implication the overall demand and supply picture over many decades in the traded commodity market. Taking away the effect of implied American inflation as the commodity index is priced in dollars gives one a very good understand of the real commodity cycle. This cycle seem to have had only four major peaks over the last 130 years or so.